Credit Management Solutions in Clancy

Simple and effective credit management solutions to resolve your Clancy past due debt obligations.

Clancy Credit Management Consultants

Professional team of credit management consultants to provide you credit management counseling in Clancy.

Credit Management Services in Clancy

Best credit management services in Clancy to help you in handling your tough debt situations.

Professional Credit Management Services in Clancy

Bankruptcy in Clancy

Ensure your bankruptcy petition is filed correctly and in a timely manner to avoid bankruptcy.

Credit Card Debt in Clancy

Get out of credit card debt to avoid any kind of negative impact on your financial well-being.

Clancy Credit Card Debt Relief

Comprehensive credit card debt relief solutions to your unique financial needs and stability.

Credit Repair in Clancy

Review and monitor your credit report to improve your credit score with credit repair services.

Clancy Debt Collection

Choose a debt collection agency to help you make arrangements to pay the outstanding debt.

Debt Relief in Clancy

A credit management firm can help you get a debt relief program to resolve your debt issues.

Trusted Credit Management Specialists in Clancy

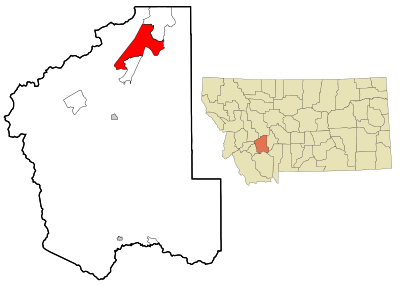

Rubicon Credit Management - The Best Credit Repair And Management Company in Clancy, MT

The credit score of an individual can be very important in a number of scenarios. It is essential to keep it as high as possible. This can be difficult, however, when you don't know how to manage your credit effectively. At Rubicon Credit Management, we help you do just that - manage your credit score and responsibly use your available Credit Lines. We understand the complexities of credit management which is why we provide tailored solutions for our clients. We can help you understand your Credit Score and the factors that determine it so that you can make informed decisions about how to use your credit. Our team of highly experienced professionals can provide critical guidance to help you manage your finances better.

We are a credit repair company that's committed to helping our clients reach their financial goals and maintain good credit standing. Our services include debt negotiation, lawsuit defense, credit restoration, Debt Settlement, dispute resolution, and credit report review. We also assist in developing an action plan for improving your financial situation. When you choose Rubicon Credit Management, you can rest assured that you have made the right decision.

Rubicon Credit Management's Credit Repair Services in Clancy, MT

Our credit restoration service helps you get back on track with your credit and put a stop to any issues that may have been affecting your credit score. We are composed of a team of professionals who specialize in Repairing Bad Credit, disputing inaccuracies in your report, and helping you build a strong financial future. We understand how important it is for our clients to have good credit. That's why our team works hard to provide the best service possible. Our experts will advise you on how to manage your debt, build a budget and save, dispute any discrepancies or inaccuracies on your report, and help you rebuild an impressive credit score. We also offer Credit Counseling Services that are designed to educate our clients on the importance of managing their credit, budgeting, and saving. Our team will work closely with you to create a plan that fits your individual needs so that you can achieve financial freedom in no time.

We are proud to be one of the most trusted names in the industry when it comes to helping people manage their credit. We understand that everyone's situation is unique and we are dedicated to providing personal, knowledgeable service that will get you back on track with your credit. If you're ready to take control of your financial future, contact Rubicon Credit Management today for a consultation. You can call us at 877-600-2345.

Selecting a Good Credit Repair Company - Why Choose Rubicon Credit Management?

Rubicon Credit Management is the right choice if you’re looking for a Credit Repair Company that can help you get out of debt and improve your credit score. Our experienced team has been in the credit restoration and debt business for a long time, enabling us to provide effective services such as credit counseling, debt settlement, credit restoration, and debt lawsuits.

We also fully comply with all credit reporting guidelines and regulations, ensuring that the methods we use to help you repair your credit are legal and effective. Our long list of clients speaks volumes when it comes to our commitment to helping people reach their financial goals. No matter what kind of Credit Issue you’re facing, Rubicon Credit Management is here to help. Contact us today and let’s get started on the road to financial freedom. Don’t wait any longer - let us help you manage your credit.

Credit Repair in Clancy, MT

What are credit scores and credit repair?

Credit scores are three-digit numbers that lenders use to evaluate your creditworthiness. Credit repair is the process of correcting errors in your Credit Report and improving your credit score.

How long does it take to repair my credit?

The amount of time it takes to repair your credit varies depending on the severity of the damage, but, on average, it can take anywhere from six months to a year.

What documents do I need for credit repair?

You will need your most recent credit report, as well as any supporting documents (bank statements and letters of dispute) that you can provide.

What is the best way to improve my credit score?

The best way to improve your credit score is to pay bills on time, keep your debt levels low, and avoid applying for new credit. Additionally, our credit counseling and Credit Optimization Services can help you get your credit score on the right track.

Are there myths about credit one should know?

There are a lot of myths out there about credit. Here are a few:

-

Closing unused credit cards will improve your credit score.

-

You need to carry a balance on your credit card to build credit.

-

Checking your own credit report will lower your score.

-

Paying off debt will immediately improve your credit score.

At Rubicon Credit Management, we understand that managing your credit can be a challenging task. That’s why we are dedicated to helping you navigate the process and reach your financial goals. We offer Personalized Credit Counseling and optimization services to help you repair your credit and improve your score. Contact us today for more information or to get started!

FCRA and Credit - What's the Relationship?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how credit bureaus, credit repair agencies, and other entities report information about you to potential lenders and creditors. It also requires the provision of Monthly Payment Histories to those who obtain your credit report. This means that when someone reviews your credit report for an application for a loan or credit, they will have access to your payment history for the past several months. This information can help them determine your creditworthiness and make a better decision about whether or not to extend you credit.

The FCRA also requires that only accurate information is reported to potential lenders and creditors. If there are any errors on your report, you have the right to dispute them with the credit bureaus. This can help ensure that your credit score is not lower than it should be due to inaccurate information. The FCRA also allows consumers to receive a free copy of their Credit Report every 12 months from each of the three major credit bureaus (Experian, Equifax, and TransUnion). This is important for making sure that your credit report does not contain any inaccurate or outdated information. If there are any errors on your report, you can contact the credit bureaus to dispute them. Finally, the FCRA also requires that Credit Repair Agencies disclose their terms of service in writing before they start any work. This is important as it helps to ensure that consumers understand exactly what services they are receiving and how much they will be charged for them.

In summary, the Fair Credit Reporting Act regulates how credit bureaus, credit repair agencies, and other entities report information about you to Potential Lenders and creditors. It also requires the provision of monthly payment histories to those who obtain your credit report. Additionally, it allows consumers to receive a free copy of their credit report every 12 months and requires that credit repair agencies disclose their terms of service in writing before they start any work. All these factors help ensure that you have access to accurate information about your Financial Credit History and are able to make informed decisions about your credit.

Credit Card Debt in Clancy, MT

The average person in the US carries about $6,270 worth of credit card debt. Looking at these spiking numbers, it is important to fight credit card debt. Here's how you can do it:

Transfer to 0% APR credit card

One option is to transfer your balance to a 0% APR credit card. This means you won't incur any interest on the balance for an extended period of time, usually 12-18 months. Doing this may provide relief from interest charges and help you pay off your debt faster.

Work with a credit counseling/debt settlement company.

You may also consider working with a credit counseling or Debt Settlement Company in Clancy, MT like Rubicon Credit Management. Our professionals can negotiate with your creditors to get you lower interest rates and possibly even have some of your debt forgiven. We can also devise an Affordable Payment Plan that fits your budget so you can get on track with paying off your debt.

Ignoring credit card debt; should you do it?

Ignoring your credit card debt is not a good idea. Your creditors may eventually turn it over to a collection agency, which will aggressively try to Collect The Debt from you. If they win a lawsuit against you, they can garnish your wages or put a lien on your property. Therefore, it is important to take action if you are struggling with credit card debt.

Is credit card debt forgiveness possible?

When it comes to credit card debt forgiveness, nothing can be said for certain. It all depends on the situation and whether or not the Creditors are willing to negotiate. That's where Rubicon Credit Management can help. We specialize in helping people manage their credit through debt negotiation and forgiveness. Call us at 877-600-2345 for more information.

Collection

The Collection Process in Clancy, MT:

The collection process is the steps necessary to collect a debt from a debtor. The process usually begins with sending out an invoice or other type of notice to the borrower, followed by attempts at contact and negotiation. If there is no response or agreement in place, legal action might be taken, including placing liens on property, repossessing collateral, or filing a lawsuit.

Collection Agencies in Clancy, MT:

Collection agencies are companies that specialize in helping creditors recover Delinquent Debts from borrowers. They typically employ agents and have access to various databases and collection tools. Collection Agencies may work on a commission basis with creditors, meaning they receive a percentage of the money they collect. It is important for creditors to work with a reputable agency and ensure that all collection practices are compliant with local laws.

Collection Strategies in Clancy, MT:

When it comes to Collecting Debt, there are numerous strategies available. Depending on the situation, creditors may choose to set up payment plans or negotiate settlements. In some cases, they might also decide to accelerate collection by taking legal action, such as filing a lawsuit. It is important for creditors to understand the laws and regulations governing debt collection in their jurisdiction.

Clancy Debtor Rights:

When it comes to debt collection, lenders must adhere to strict rules and regulations in order to protect borrowers from unfair practices. Debtors have rights under both federal and state laws that prevent creditors from harassing them or taking excessive action. Knowing their rights can help debtors protect themselves and ensure that any collection activity is conducted in a fair and lawful manner.

Types of Collections in Clancy, MT

Lastly, there are several different types of collections that creditors can use to pursue delinquent debts. These include conventional collection methods, such as letters and phone calls, as well as specialized services like skip tracing and asset location. Additionally, Third-Party Collection Agencies may be employed to handle the more difficult cases. Understanding the various options available can help lenders choose the most effective and cost-efficient approach for recovering their debts.

What happens when you don't pay Clancy, MT collections?

If you don't pay a debt in collections, the creditor may decide to take legal action against you. This could include filing a lawsuit, placing liens on your property or assets, or garnishing your wages. In some cases, the debt collector might also report the delinquency to Credit Reporting Agencies, which could hurt your credit score.

Debt Settlement in Clancy, MT

Debt settlement is a popular Debt Relief option that can help you reduce your debt and get back on track financially. It involves negotiating with creditors to pay less than the full amount you owe, which can damage your credit score but may be necessary if you're facing financial hardship.

What are the debt settlement qualifying requirements?

In order to qualify for debt settlement, you must have a certain amount of Unsecured Debt. This is typically about $10,000 or more; the exact amount varies by lender. Additionally, your creditors must be willing to negotiate with you and agree to settle your debt for less than what you owe.

What are the steps involved in debt settlement?

The first step of the debt settlement process is to contact your creditors to explain your situation. You should let them know that you are unable to pay the full amount of your debt and that you would like to Negotiate A Lower Payment. Next, you will need to set up a separate savings account for your settlement funds. You should try to save up as much money as possible in this account to use towards your settlements. Once you have saved enough money, you can contact the creditors again and offer a Lump Sum Payment that is lower than what you originally owed. The creditor may accept the offer or counter with another amount; either way, it is important to continue negotiating until you reach an agreement. Finally, once the terms of the settlement have been agreed upon, you will need to send in your payment and close the account.

Statute of Limitations and Knowing Your Rights

The statute of limitations is the amount of time you have to file a lawsuit against someone for Unpaid Debt. The exact amount of time varies by state and type of debt, but it typically ranges between two and six years. If the statute of limitations has passed, you will not be able to sue the person or company who owes you money. It is important to be aware of the statute of limitations for your debt because if you miss the deadline, you will not be able to take legal action against them. However, in some cases, creditors may still try to collect on a debt even after the statute of limitations has expired.

What are the risks associated with debt settlement?

Debt settlement can be risky as it can damage your credit score and make it more difficult to get approved for loans in the future. Additionally, you may be subject to Tax Penalties as forgiven debt is considered income by the IRS. In addition, creditors may not agree to your settlement offer and continue to pursue payment from you. Finally, some Debt Relief Companies in Clancy, MT can be costly and not always effective. It's important to do your research before hiring one of these companies. Debt settlement can be a viable option for those who have large amounts of debt and are struggling to make payments. However, it's important to weigh the pros and cons carefully before deciding if this is the right path for you.

Rubicon Credit Management is a company that specializes in helping individuals and businesses manage their debt. We offer services such as Debt Consolidation, credit counseling, budgeting assistance, and more. Contact us today to learn how we can help you get out of debt without paying anything. If you need more information about getting out of debt without paying, contact Rubicon Credit Management at 877-600-2345.

Bankruptcy

What is it?

Bankruptcy is a legal process that allows people who are in financial trouble to get relief from their debts and start fresh. Bankruptcy can stop creditor harassment, foreclosures, repossessions, wage garnishments, and other collection actions.

Types of Bankruptcy

There are three common types of bankruptcy: Chapter 7, Chapter 11, and Chapter 13. Each one has its own requirements and benefits.

Chapter 7 bankruptcy is a Liquidation Bankruptcy, where all of your non-exempt assets are sold off to pay creditors. After the sale, most of your unsecured debts will be discharged. However, some debts, such as Student Loans, taxes, and alimony cannot be discharged in a Chapter 7 bankruptcy.

Chapter 11 bankruptcy is a reorganization bankruptcy, which allows you to reorganize your debts and create a Repayment Plan. In this type of bankruptcy, you are allowed to keep all of your assets. Chapter 11 bankruptcies tend to be more complicated than other types, so it may take longer for them to be completed.

Chapter 13 bankruptcy is a reorganization bankruptcy for individuals. It allows you to keep your assets and make payments on your debts over 3-5 years, after which the Remaining Debt is discharged. To qualify for Chapter 13 bankruptcy, you must have a steady income and be able to pay back some of your creditors in full or provide them with interest payments.

Process and Effects

No matter which type of bankruptcy you decide to file, it is important to understand the process and its effects. The process starts by filing a petition with the court. After that, your creditors will be notified and you must attend a meeting of creditors. During this meeting, your creditors may ask questions about your finances and assets. After the meeting, you must take Credit Counseling and debtor education courses. Once you complete these requirements and make payments through a repayment plan, your debts, if any, will be discharged. However, it is important to note that bankruptcy will stay on your credit report for seven to 10 years. This can make it difficult to get new credit and loans.

Is everything forgiven when you declare bankruptcy?

No, not all debts can be discharged in bankruptcy. Generally, only unsecured debts such as credit card debt, medical bills, and Personal Loans are eligible for discharge. Secured debts such as mortgages and car loans cannot be discharged in bankruptcy. Additionally, child support payments, alimony, most taxes, and student loans are not eligible for discharge. It is important to understand that Filing For Bankruptcy has a major effect on your credit score and can stay on your credit report for seven to 10 years. It is also important to note that some debts, such as child support payments, are not eligible for discharge in bankruptcy. If you are considering bankruptcy, it is important to talk to a qualified attorney to understand all of your options and make the best decision for your situation. Rubicon Credit Management is an industry leader in providing credit counseling and Debt Settlement Services, helping people better manage their finances. Our team of certified credit counselors can provide personalized guidance and develop a customized plan to help you get out of debt as quickly and efficiently as possible. Contact us today for more information.

Debt Relief in Clancy, MT

Debt relief means reducing or eliminating debt. It could involve settling, restructuring, or consolidating your debts in order to reduce the amount that you owe and the overall cost of paying them off. There are several Types Of Debt Relief available for individuals with different financial circumstances:

-

Debt Settlement: Negotiating with creditors to reduce the amount owed.

-

Debt Consolidation: Combining several debts into one loan.

-

Debt Management Plans: Payment plans designed to help manage the repayment of debt.

-

Bankruptcy: A legal declaration that an individual or business is insolvent and unable to pay its debts.

Clancy Benefits of Debt Relief

There are many benefits such as:

1. Financial Freedom

Debt relief can help you regain financial stability. It helps you to reduce your debt burden and restructure payments so that you can build a better financial future. Debt Relief Programs could also allow you to pay off your debts in full, giving you the freedom to use your finances however you wish.

2. Peace of Mind

Debt relief can bring peace of mind to those struggling with debt by providing a solution to their problem. By reducing the amount owed and Restructuring Payments, you can reduce your stress and focus on other important matters in life.

3. Tax Benefits

In certain cases, debt relief may also come with tax benefits. In other cases, however, your forgiven debt may be considered Taxable Income and you might have to pay taxes on the amount that was forgiven.

4. Credit Score Increase

Debt relief can also improve your credit score if you make regular payments on time and keep balances low. Paying off your debts can significantly Improve Your Credit Score and boost your chances of getting approved for future loans.

5. Improved Cash Flow

Debt relief can also help improve cash flow by reducing the amount you owe, lowering interest rates, and restructuring payment plans. This improved Cash Flow can help you manage other expenses such as rent or utilities, while still being able to meet your monthly debt payments.

Drawbacks of Debt Relief

Upfront Fees: Depending on the type of debt relief program you pursue, there may be upfront fees associated with enrolling.

Credit Score Impact: Depending on the type of debt relief program you pursue, it could have a negative impact on your credit score.

Tax Implications: There may be tax implications associated with some types of debt relief.

How Do I Choose the Best Type of Debt Relief for Myself?

The best type of debt relief for you depends on your individual financial situation. Consider the following factors before deciding:

How much debt do you have?

If you have a large amount of debt, it may be better to pursue more aggressive forms of debt relief such as debt consolidation or bankruptcy.

What type of debt do you have?

Different types of debts require different strategies for repayment. For example, if most of your debts are Credit Cards, a debt consolidation loan may be the best option. On the other hand, if you have student loans or medical bills, an income-driven repayment plan may be more appropriate.

What is your credit score?

Your credit score will determine which types of debt relief are available to you and what interest rate you’ll receive. For example, if you have a Good Credit Score, you may qualify for a balance transfer or debt consolidation loan with a lower interest rate.

What are your financial goals?

Consider your short-term and long-term financial goals before choosing a debt relief option. If you want to become debt free as quickly as possible, a debt settlement or bankruptcy may be the best option. If you want to minimize the impact on your credit score, a Balance Transfer or debt consolidation may be better.

By considering these factors and researching all of your options, you can find the best type of debt relief for your individual situation. Get started today by talking to a financial advisor or Credit Counselor. They can help you evaluate your debt, create a plan to reduce or eliminate it, and choose the best debt relief option for your needs.

When to Seek Professional Help?

If you are having difficulty managing your finances and considering different types of debt relief, it is recommended that you seek professional help. A financial advisor can provide guidance on the Best Type Of Debt Relief for you, evaluate your current financial situation, and make recommendations to help improve your overall financial health. Here's where we come in. Rubicon Credit Management can help you with your debt relief needs. We are a team of dedicated and experienced professionals who specialize in helping people to find the best debt relief options for their unique situations. Our goal is to help you get back on track financially and create a plan that fits your individual circumstances. Contact us today at 877-600-2345.

Foreclosure

A foreclosure is a legal process in which a lender takes possession of the property because the owner has defaulted on their loan payments.

Foreclosure Consequences

The consequences of a foreclosure can be long-lasting and devastating, including ruined credit scores, difficulty finding another home or apartment, significant financial losses, and even homelessness.

Steps to Prevent a Foreclosure

Fortunately, there are steps that can be taken to avoid foreclosure. First, contact the lender immediately if payments can no longer be made. They may be willing to work out an alternative Loan Repayment Plan that is more affordable for the borrower. It's also important to keep up with other bills, such as utilities and food expenses, so that money can stretch further.

Deed in Lieu

A deed in lieu of foreclosure is another way to avoid foreclosure. This involves signing the property over to the lender instead of going through a long and expensive foreclosure process. However, this should only be done with extreme caution as it may not actually save a home or Reduce Debt in some cases. In addition to these options, government programs are available that can help borrowers facing foreclosure. These might include Loan Modification Programs, short sales, or even forbearance. It's important to research all available options before making a final decision. Ultimately, avoiding foreclosure is the best way to minimize financial damage and save a home from being taken away.

Lien in Debt

A lien is a form of security interest granted over an asset or property to secure the Payment Of A Debt or other obligation. Liens are commonly used as a way for creditors to have some assurance that they will be repaid if certain conditions are not met, such as when loans are taken out for large purchases like cars and homes.

Voluntary Lien

A voluntary lien is a type of lien that a debtor voluntarily places on their property in order to secure repayment of a loan or other Debt Obligation. The creditor may take this security interest as long as the terms are agreed upon by both parties, and the debtor willingly grants permission for the creditor to do so. This type of lien is most often applied to real estate and major purchases like cars, furniture, or equipment. It may also be used in the context of a contractual agreement between two parties.

Involuntary Lien

An involuntary lien occurs when a creditor obtains a lien on property without the consent of the debtor. This type of lien can occur as a result of a court order, or when a creditor successfully seizes property in lieu of payment for an unpaid debt. Tax Liens and mechanics’ liens are examples of involuntary liens. It is important to understand that when it comes to a lien in debt, the creditor holds the upper hand as they can take possession of any asset securing the debt if the debt is not paid. This is why it is important for borrowers to understand what they are agreeing to when they enter into a Loan Agreement and be sure that their repayment plan is realistic and affordable. It is also important to remember that liens can remain on a person’s credit record for several years, making it more difficult to obtain Additional Credit in the future. In conclusion, understanding lien in debt is a critical part of managing personal finances and understanding the risks associated with taking out a loan or other debt obligation. Knowing what types of liens apply to different situations and being aware of any possible consequences can help borrowers make smart decisions when it comes to borrowing.

What to be Aware of When Looking at Credit Repair Companies in Clancy, MT

When you're out there searching for a credit company, consider these factors:

1. Reputation

The reputation of the credit repair company is an important factor to consider. It is important to research customer reviews, look for recommendations from friends or family, and read up on any complaints about the company that has been filed with government agencies.

2. Services Offered

It is important to make sure that the credit repair agency offers a variety of services and options. These can include removing inaccurate information from your report, challenging inquiries, providing advice on how to improve your score, and handling disputes with creditors.

3. Cost

The cost of hiring a credit repair company should also be taken into consideration. It is important to compare the prices of different companies and make sure that the services they provide are worth what they charge. Be wary of companies that promise results with little or no effort on your part.

4. Guarantees

It is important to look for a company that offers guarantees. This can include a guarantee that any mistakes on your credit report will be removed, or that any debts you have will be cleared. These guarantees should be in writing and clearly outlined before signing any contracts with the company. It is also important to look for a company that offers a money-back guarantee if they are unable to deliver on their promises.

5. Customer Service

Make sure that the credit repair company has a good customer service track record. A company should be available to answer any questions or concerns you may have, as well as provide helpful advice. This can help to ensure that your Credit Repair process goes as smoothly as possible.

6. Transparency

The company should be transparent in its dealings with you. A reputable company will provide Detailed Billing Statements and clearly explain their fees and services before you sign any contracts. This will help to ensure that you understand exactly what services and costs are associated with the Credit Repair Process. Overall, these are some of the key factors to consider when looking for a credit repair company. It is imperative that you thoroughly research and make sure that the company you choose has a good reputation and offers a variety of services.

Clancy Credit Restoration - What You Need to Know:

Credit restoration is a process of improving the creditworthiness of an individual or business. It can involve anything from disputing incorrect information on credit reports to correcting errors in how your accounts are reported by creditors; from negotiating with lenders to remove negative items from your report to Paying Down Debt. Credit restoration can be done through do-it-yourself methods or with the help of a professional credit repair company.

Credit Repair vs Credit Restoration

The primary difference between credit repair and credit restoration is that credit repair focuses mainly on disputing errors on your credit report, whereas Credit Restoration Services take a more holistic approach by addressing the underlying issues that led to those negative items in the first place. It's also important to note that Credit Repair Services have been proven to be ineffective in improving credit scores. Credit restoration, on the other hand, has a much more comprehensive approach and can help you improve your creditworthiness over the long term.

Rubicon Credit Management Services in Clancy, MT

Rubicon Credit Management (RCM) is a professional credit restoration service that specializes in helping clients restore their credit scores by providing customized strategies and personalized service. RCM will analyze your credit report, identify areas of improvement and develop a custom plan to help you achieve your goals. We offer services such as dispute management, Debt Negotiation, budgeting help, counseling on credit habits, and more. Our team of experts can work with you every step of the way to ensure that you reach your goals quickly and effectively.

Clancy Credit Card Debt Lawsuit

If you fail to make your monthly payments on time, the credit card company has the right to take legal action against you. They may do this by filing a lawsuit in court and obtaining a judgment from the judge. A judgment is a court order that requires you to pay the debt. The Credit Card Company may also garnish your wages or levy your bank account to Collect The Debt. If you are sued for credit card debt, it is important that you take action immediately. It is best to contact a knowledgeable attorney who can review your case and provide advice on how to proceed. You may also want to contact Rubicon Credit Management, which assists consumers with credit card debt lawsuits. We offer a variety of services to those who are facing Credit Card Debt Lawsuits. These include assistance with filing an answer to the complaint, preparing for trial, and representing you in court. We also provide resources to help you understand the legal process, and have counselors available to discuss payment options or negotiate settlements.

Rubicon Credit Management - The Best in this Business

At Rubicon Credit Management, we guarantee quick results and customer satisfaction. Our services are tailored to meet the needs of each individual’s unique Credit Situation. We have a team of experienced and knowledgeable professionals who can guide you through the process and help you make informed decisions about your credit repair options. Plus, our prices are highly competitive and our customer service is second to none. Contact us today and let us show you why we're the best in this business!

Frequently Asked Questions About Residential Gate Repair

Lorem

Lorem

Lorem

- Absarokee

- Anaconda-Deer Lodge County

- Baker

- Belgrade

- Big Sky

- Big Timber

- Bigfork

- Billings

- Bonner-West Riverside

- Boulder

- Bozeman

- Browning

- Butte-Silver Bow

- Chinook

- Choteau

- Clancy

- Colstrip

- Columbia Falls

- Columbus

- Conrad

- Corvallis

- Crow Agency

- Cut Bank

- Deer Lodge

- Dillon

- East Helena

- East Missoula

- Eureka

- Evergreen

- Forsyth

- Fort Belknap Agency

- Fort Benton

- Four Corners

- Frenchtown

- Glasgow

- Glendive

- Great Falls

- Hamilton

- Hardin

- Harlowton

- Havre

- Helena

- Helena Flats

- Helena Valley Northeast

- Helena Valley Northwest

- Helena Valley Southeast

- Helena Valley West Central

- Helena West Side

- Kalispell

- King Arthur Park

- Lakeside

- Lame Deer

- Laurel

- Lewistown

- Libby

- Lincoln

- Livingston

- Lockwood

- Lolo

- Malmstrom AFB

- Malta

- Manhattan

- Marion

- Miles City

- Missoula

- Montana City

- North Browning

- Orchard Homes

- Pablo

- Park City

- Plains

- Plentywood

- Polson

- Red Lodge

- Ronan

- Roundup

- Scobey

- Seeley Lake

- Shelby

- Sidney

- Somers

- South Browning

- Stevensville

- Sun Prairie

- Thompson Falls

- Three Forks

- Townsend

- West Glendive

- West Yellowstone

- White Sulphur Springs

- Whitefish

- Whitehall

- Wolf Point