Consult With Experts For Debt Relief Programs in Fort Belknap Agency, MT. Find Professional Debt Relief Services For Debt Relief Management And Debt Relief Settlement.

Debt relief is something that more and more people are turning to as they struggle under the weight of their debts. If you're feeling overwhelmed by your debt, you're not alone. Millions of Americans find themselves in the same position every year. Fortunately, there are options available for those who need help getting their finances back on track. Rubicon Credit Management is a Credit Management Firm in Fort Belknap Agency, MT and we can help you with debt relief. In this article, we'll discuss what debt relief is, how it works, and who can benefit from it. We'll also talk about the different types of debt relief programs available to consumers in Fort Belknap Agency, MT. So, let's begin:

What is Debt Relief?

Debt relief is a way to help individuals and businesses resolve their Debt Issues. It can involve negotiating with creditors to lower the amount of money owed or even eliminating it altogether. Rubicon Credit Management offers customized solutions for clients in need of debt relief. We understand that everyone’s financial situation is unique and tailor our services accordingly.

The Relationship Between Debt Relief and Your Credit Report

Do you have debt? Are you considering a debt relief program to pay off your debts? Then, it's important that you understand the relationship between debt relief and your credit report. Debt relief is a process that allows individuals to obtain lower payments by negotiating with creditors or consolidating their payments into one Single Monthly Payment. Debt relief can help you pay off your debts quickly, but it can also have a negative impact on your credit report. When pursuing debt relief, some of the payments that you make may not be reported to the credit bureaus, which will cause your credit score to decrease. At Rubicon Credit Management, we understand how important it is for our clients to maintain a Good Credit Score. We also understand the financial relief that debt relief can provide. That's why we always recommend that our clients pursue debt relief as part of their overall financial strategy while being mindful of how it affects their Credit Reports and score. Our team will work with you to develop a customized plan that takes your credit score into account. We can provide you with advice that will help you build a stronger financial future and make sure your credit report is accurate and up to date. We work closely with our clients to develop comprehensive strategies for debt relief and help them navigate the complexities of the process. Our goal is to help you gain control over your finances while reducing the Amount Of Debt you owe. We are committed to providing our clients with personalized solutions that help them get out of debt and improve their credit scores. Our experienced team is here to provide you with the tools and knowledge needed to make sound financial decisions and achieve your debt relief goals. Contact us today at 877-600-2345 to get started.

What are Debt Relief Programs Designed for and How Do They Work?

Debt relief programs are designed to help people who have difficulty paying off their debt. These programs can provide individuals and families with a structured plan to manage and reduce their debt in an affordable way, while also providing Credit Counseling Services that can improve financial mastery.

Working Mechanism of a Debt Relief Program

The first step is for the individual or family to contact a reputable debt relief program provider. This can be done through a phone call, online inquiry, or in-person visit. During this initial meeting, the debtor will provide information about their financial situation and goals. The debt relief program provider then evaluates the individual’s finances to determine if they are eligible for any of their available programs. The most common debt relief programs are Debt Consolidation, debt settlement, and consumer credit counseling. With a debt consolidation program, the debtor takes out a loan to pay off their existing debts. This can simplify their payment process by combining multiple payments into one monthly payment. Debt settlement involves negotiating with creditors to reduce the amount owed or reduce the interest rate on the outstanding balance. Consumer Credit Counseling is a service that helps individuals learn how to budget and manage their money more effectively.

Once the debtor has chosen which program best fits their needs, they can work with their debt relief provider to create a plan for repayment. This plan should include detailed information such as payment schedules, interest rates, monthly payments, and any other relevant information. The debt relief provider may also provide guidance on how to handle Debt Collections and other creditors. Most importantly, the debt relief program should assist the debtor in understanding their finances and budgeting better so they can prevent future debt issues. This includes advice on creating a budget, setting up emergency funds, Controlling Credit Card Use, and more. Having access to this kind of personalized guidance can be invaluable in helping someone get and stay out of debt. Overall, a debt relief program is designed to provide individuals with the resources and support needed to manage and pay off their debts in an affordable way. Through access to personalized guidance, credit counseling services, and other tools, these programs can help people get back on track financially and regain control of their financial lives. If you are struggling with unmanageable debt, reach out to Rubicon Credit Management for more information about our debt relief programs.

The 3 Types of Debt Relief Programs

Debt relief can be a great way to get back on your feet financially and move toward financial freedom. At Rubicon Credit Management, we believe in helping our clients achieve their goals by learning about the different Types Of Debt Relief Programs available. Here is an overview of the three types of debt relief:

1. Unsecured Debt Relief Program

Unsecured debt relief programs, such as credit counseling or debt negotiation/settlement, provide a way for consumers to reduce their Unsecured Debts without resorting to bankruptcy. With unsecured debt relief programs, you can pay off your loans at a reduced rate and with fewer total payments.

2. National Debt Relief Program

The national debt relief program is available for those who are unable to negotiate or settle their debts on their own. This type of debt relief provides consumers with a way to reduce the amount they owe, usually through negotiation with creditors. The main benefit of these programs is that your Credit Score will not be affected, as the debts are written off.

3. Personal Loan Debt Relief Program

Personal loan debt relief programs are designed to help those with high-interest personal loans by providing them with a lower interest rate and Better Repayment Terms. These types of debt relief options can often be beneficial for consumers who may have taken out too many Personal Loans or have become overwhelmed with debt. At Rubicon Credit Management, we understand that no two financial situations are the same and that is why we offer valuable advice on which debt relief programs you should go for. Our team of experienced professionals will work with you to find the best debt relief solution for your individual situation. Contact us today at 877-600-2345 to learn more.

Fort Belknap Agency Debt Settlement and Its Benefits

In today’s economic climate, debt settlement companies are becoming increasingly important for individuals and businesses alike. At Rubicon Credit Management, we understand the importance of managing debts in a way that will benefit both you and your creditors. That’s why we offer our clients an array of Debt Relief Solutions, including debt settlement. What is debt settlement? Simply put, it’s an agreement between you and your creditors to settle current debts for less than the full amount owed. In order to qualify for Debt Settlement, you must have a delinquent balance on your unsecured debts such as credit cards, medical bills, and personal loans. The process involves negotiation with your creditors in order to reduce the total amount of debt you owe and go debt free.

The process of debt settlement can be complex and intimidating, but it doesn’t have to be. With Rubicon Credit Management, we make the process straightforward and stress-free. We will work with your Creditors on your behalf in order to negotiate reduced payment amounts that are affordable, and we will develop a settlement offer that is acceptable to both you and your creditors. With our debt relief services, you can expect:

-

Reduced interest rates and reduced late fees;

-

Consolidated payments for all of your debts;

-

A single payment each month instead of multiple bills;

-

A possible reduction in the total amount owed;

-

The opportunity to pay off your debt in as little as 12-36 months;

-

Professional, experienced negotiation with creditors;

-

Improved credit score over time.

If you’re looking for an affordable and effective way to manage your debts, then debt settlement could be the right choice for you. Contact Rubicon Credit Management today.

Fort Belknap Agency Debt Consolidation - What You Need to Know

At Rubicon Credit Management, we understand how overwhelming managing your debts can be. That’s why we offer debt consolidation services to make the process easier and help you get out of debt faster. Debt consolidation is a Type Of Debt Relief that combines all of your existing debts into one single payment. This means instead of making multiple payments to different creditors each month, you make one payment to Rubicon Credit Management and we will distribute the funds appropriately. Additionally, debt consolidation can help reduce your interest rate and provide a more Flexible Repayment Plan. With our services, you’ll have access to professional financial advice that can help you lower your debt burden and establish effective financial habits. Moreover, since you’ll be making only one monthly payment instead of multiple payments, it will make tracking your debt much simpler and easier for you. We can also help you determine which debts are causing the most financial strain and advise on ways to address them more effectively.

What is a Fort Belknap Agency Debt Management Plan? How We Can Help

A debt management plan (DMP) is a process of consolidating debts into one monthly payment. It’s an agreement between you and your creditors that helps you to pay off your debts in a way that works for both parties. At Rubicon Credit Management, we work with clients to create customized DMPs tailored to their Individual Debt Circumstances. Our team will work with you to create a payment plan that fits your budget and timeline while ensuring your creditors receive the payments they are owed. Furthermore, we understand how important it is to keep track of all of your Financial Obligations, which is why we offer online tools and resources designed to help you monitor your progress and stay on track. We also provide Personalized Debt Counseling Services to help you develop the financial habits needed to build a stronger financial future. With our assistance, you can understand and manage your debt more effectively while taking steps toward becoming debt-free.

Debt Settlement and Debt Relief Services in Fort Belknap Agency, MT by Rubicon Credit Management

At Rubicon Credit Management, we offer a wide range of debt relief and debt settlement services for individuals who are struggling with their finances. Our team of experienced financial professionals is dedicated to helping our clients Get Out Of Debt and achieve financial freedom. We understand that everyone's needs are different when it comes to managing their debts. That's why we offer Personalized Debt Relief Plans tailored to our client's unique situations. We can negotiate with creditors on your behalf and help you create a budget that fits your lifestyle. Our services include:

-

Negotiating lower interest rates, and monthly payments, and/or removing late fees and penalties.

-

Creating a personalized debt repayment plan that fits your budget.

-

Providing ongoing support and guidance throughout the process.

-

Helping you build a strong financial foundation for the future.

If you're ready to take control of your finances and start down the path to Debt-Free Living, contact Rubicon Credit Management today to learn more about our comprehensive debt relief services. Contact us at 877-600-2345.

Conclusion

Debt relief can be an invaluable tool for those struggling with debt. It is important to understand all the options available, including credit counseling, debt consolidation, and debt settlement. Doing your research and speaking with qualified professionals will help you make an informed decision on which type of relief program best fits your situation. We are a credit counseling and Debt Relief Organization that can help you make educated decisions when it comes to your finances. We are here to offer financial guidance, solutions, and strategies so you can take control of your debt and improve your credit score. Contact Rubicon Credit Management today for a consultation.

Frequently Asked Questions About Residential Gate Repair

Lorem

Lorem

Lorem

- Absarokee

- Anaconda-Deer Lodge County

- Baker

- Belgrade

- Big Sky

- Big Timber

- Bigfork

- Billings

- Bonner-West Riverside

- Boulder

- Bozeman

- Browning

- Butte-Silver Bow

- Chinook

- Choteau

- Clancy

- Colstrip

- Columbia Falls

- Columbus

- Conrad

- Corvallis

- Crow Agency

- Cut Bank

- Deer Lodge

- Dillon

- East Helena

- East Missoula

- Eureka

- Evergreen

- Forsyth

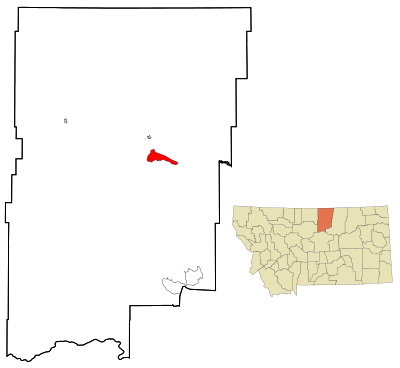

- Fort Belknap Agency

- Fort Benton

- Four Corners

- Frenchtown

- Glasgow

- Glendive

- Great Falls

- Hamilton

- Hardin

- Harlowton

- Havre

- Helena

- Helena Flats

- Helena Valley Northeast

- Helena Valley Northwest

- Helena Valley Southeast

- Helena Valley West Central

- Helena West Side

- Kalispell

- King Arthur Park

- Lakeside

- Lame Deer

- Laurel

- Lewistown

- Libby

- Lincoln

- Livingston

- Lockwood

- Lolo

- Malmstrom AFB

- Malta

- Manhattan

- Marion

- Miles City

- Missoula

- Montana City

- North Browning

- Orchard Homes

- Pablo

- Park City

- Plains

- Plentywood

- Polson

- Red Lodge

- Ronan

- Roundup

- Scobey

- Seeley Lake

- Shelby

- Sidney

- Somers

- South Browning

- Stevensville

- Sun Prairie

- Thompson Falls

- Three Forks

- Townsend

- West Glendive

- West Yellowstone

- White Sulphur Springs

- Whitefish

- Whitehall

- Wolf Point